The footnote below is from the 2017 10-K report of Whole Foods Market, Inc., a Texas-based retail

Question:

The footnote below is from the 2017 10-K report of Whole Foods Market, Inc., a Texas-based retail grocery chain.

Inventories:

The Company values inventories at the lower of cost or market. Cost was determined using the dollar value retail last-in, first-out ("LIFO") method for approximately 92.9% and 91.8% of inventories in fiscal years 2017 and 2016, respectively. Under the LIFO method, the cost assigned to items sold is based on the cost of the most recent items purchased. As a result, the costs of the first items purchased remain in inventory and are used to value ending inventory. The excess of estimated current costs over LIFO carrying value, or LIFO reserve, was approximately $47 million and $42 million at September 24, 2017 and September 25, 2016, respectively. Costs for remaining inventories are determined by the first-in, first-out method. Cost before the LIFO adjustment is principally determined using the item cost method, which is calculated by counting each item in inventory, assigning costs to each of these items based on the actual purchase cost (net of vendor allowances) of each item and recording the actual cost of items sold.

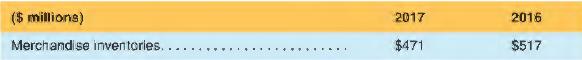

Whole Foods operates the world's largest chain of natural and organic food stores. In 2017, Whole Foods reported sales revenue of $16,030 million and cost of goods sold of $10,633 million. The following information was extracted from the company's 2017 and 2016 balance sheets:

a. Calculate the amount of inventories purchased by Whole Foods in 2017.

b. What amount of gross profit would Whole Foods have reported if the FIFO method had been used to value all inventories?

c. Calculate the gross profit margin (GPM) as reported and assuming that the FIFO method had been used to value all inventories.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman