A machine acquired for 400,000 on 1 July 2008 and depreciated at 25% p.a. using the reducing

Question:

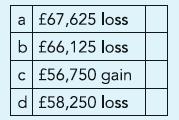

A machine acquired for £400,000 on 1 July 2008 and depreciated at 25% p.a. using the reducing instalment method was sold for £112,000 on 30 April 2011. Depreciation is time apportioned. Expenses of disposal amounted to £1,500. What is the gain or loss on disposal of the machine to be reported in the Statement of income?

Transcribed Image Text:

a £67,625 loss b £66,125 loss £56,750 gain d £58,250 loss U

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

a ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

As at 31 December 2010 a manufacturer reported at 424,000 machinery which had originally cost 840,000. A machine was acquired for 80,000 on 1 April 2011 and on 1 July 2011 a machine acquired for...

-

A machine acquired for 360,000 on 1 April 2006 and depreciated at 10% of cost per annum was sold for 112,000 on 30 September 2011. Depreciation is time apportioned. Expenses of disposal amounted to...

-

Jessica Parker is a graduate in management and finance, and is reporting in a current account maintained in the ledger the amounts she may feel free to withdraw at any time from the business. She has...

-

Assuming 250 days of operation per year and a lead time of five days, what is the reorder point for Westside Auto in Problem 15? Show the general formula for the reorder point for the EOQ model with...

-

Frank Zanca is considering three different investments that his broker has offered to him. The different cash flows are as follows: Frank only has enough savings for one investment his broker has...

-

Go to the U.S. General Services Administration (GSA) website. What is the per diem rate for lodging and M&IE for each of the following towns? a. Flagstaff, AZ b. Palm Springs, CA c. Denver, CO

-

Conway Crafters, LLC, negotiated two promissory notes with Gotham Bank. Conway secured the loans to help finance the construction of a new commercial building. Separate mortgages secured each note....

-

The following are steps in the methodology for designing tests of controls, substantive tests of transactions, and tests of details of balances for the payroll and personnel cycle: 1. Design tests of...

-

(a) An investor purchased 300 units of a Mutual Fund at Rs. 12.25 per unit on 31 December, 2009. As on 31st December, 2010 he has received Rs. 1.25 as dividend and Rs. 1.00 as capital gains...

-

Machinery acquired for 800,000 was reported at 494,000 on the Statement of financial position as at 30 June 2010. A machine was acquired for 120,000 on 1 April 2011 and another, acquired for 40,000...

-

Aslam Ismail, living in south London, exchanged his service station, acquired for 480,000 and written down to 284,000, for another (nearer his residence) with a market value of 275,000. At what value...

-

Norton Industries, a manufacturer of cable for the heavy construction industry, closes its books and prepares financial statements at the end of each month. The statement of cost of goods sold for...

-

1. Consider the distributions: (i) Gamma: f(y:0) ==> (0) (o known). (ii) Negative binomial: f(y; 0) = (+1) 0 (1-0) (r known). For (i) and (ii): (a) Determine the maximum likelihood estimate, 0, of 0...

-

Study the accounting case and the conceptual work of accountability, and then answer the questions. The accounting case: A school has provided the four different reporting forms about social...

-

What is the purpose and benefit of the polymerase chain reaction (PCR)?

-

Suppose an accountant uncovers evidence of financial fraud within their organization, but reporting it may lead to severe consequences for their colleagues and the company. What ethical principles...

-

4. Consider the function. f(x, y, z)=x+y+z+sin (az) - e-(2+y +2). Write a code that evaulates the Hessian matrix for any choice of r, y and 2. 5. Generate a random vector in matrix with entries = [1,...

-

The data in the next column represent the percentage of 18- to 24-year-olds enrolled in college. Construct a time-series plot and comment on any trends. Year Percent Enrolled Year Percent Enrolled...

-

Pedro Bourbone is the founder and owner of a highly successful small business and, over the past several years, has accumulated a significant amount of personal wealth. His portfolio of stocks and...

-

Journal entries for stock warrants. On December 7, 2002, Altus Pharmaceuticals issued shares of convertible preferred stock and warrants to purchase additional shares of preferred stock for an...

-

Journal entries for dividends. Give journal entries, if required, for the following transactions, which are unrelated unless otherwise specified: a. A firm declares the regular quarterly dividend on...

-

Journal entries for dividend. Prepare journal entries for the following transactions of Watt Corporation. The firm has 20,000 shares of $15 par value common stock outstanding on January 1, 2008. The...

-

Make a magic square using the integers -4, -3, -2, -1, 0, 1, 2, 3, 4. Complete the magic square. Two numbers are given. 3 4

-

Sally was a Driver at HandyDART for 13 full years. When Sally was a Driver, she was a union member of Unifor. Three years ago, she applied for and was given the position of Depot Manager to manage...

-

Softcore Consultancy Services is in the IT sector. It is currently facing a shortage of skilled labor and is experiencing an increase in employee salaries, which has been increasing over the past few...

Study smarter with the SolutionInn App