Machinery acquired for 800,000 was reported at 494,000 on the Statement of financial position as at 30

Question:

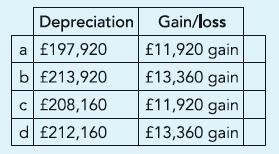

Machinery acquired for £800,000 was reported at £494,000 on the Statement of financial position as at 30 June 2010. A machine was acquired for £120,000 on 1 April 2011 and another, acquired for £40,000 on 1 July 2008, was sold for £22,000 on 31 March 2011. The depreciation is written off at 40% per annum using the reducing balance method with time apportionment. Calculate the depreciation written off in the year ended 30 June 2011 and the gain or loss on disposal of machinery.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: