After calculating net profit for the year ended 31 March 2012 WL extracted the Trial Balance which

Question:

After calculating net profit for the year ended 31 March 2012 WL extracted the Trial Balance which failed to balance and the difference was placed in a Suspense account. Further inquiries were then made, and the following errors were identified:

(i) A Payable account had been debited with £300 sales invoice (which had been correctly recorded in the Sales account).

(ii) The Heat and light account had been credited with £150 paid for gas.

(iii) G. Gordon has been credited with a cheque for £800 received from another customer, G. Goldman.

(iv) The Insurance account contained a credit entry for insurance prepaid of £500, but the balance had not been carried down and hence omitted from the above Trial Balance.

(v) Purchase returns had been overcast by £700.

Required:

(a) Prepare journal entries to correct each of the above errors.

(b) Open the Suspense account at 31 March 2012 and enter the relevant corrections.

(c) Recalculate the net profit for the year to 31 March 2012.

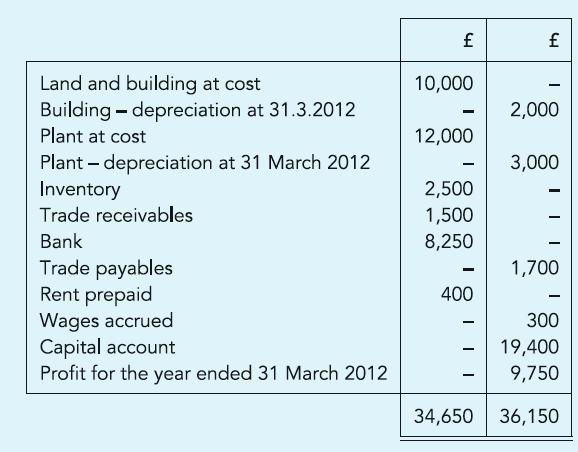

(d) Prepare a Statement of financial position as at 31 March 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict