Blue and Green were in partnership, sharing profits in the ratio 2:1 respectively, after allowing 4% per

Question:

Blue and Green were in partnership, sharing profits in the ratio 2:1 respectively, after allowing 4% per annum interest on capital and paying Green a salary of £1,000 per month. Red worked as their office manager and was paid a salary of £1,000 per month. Red was admitted to partnership as from 1 January 2012 on the basis of the following agreement:

■ Green, Blue and Red are to share profits in the ratio 2:1:1 respectively, after continuing to allow interest on capital at 4% per annum and continuing to pay Green a salary of £1,000 per month.

■ Red’s loan is to be regarded as his capital and, as a partner, Red will cease to receive any salary.

■ Land is to be revalued and recorded at £450,000.

■ Goodwill, valued at £240,000, is not to be recorded.

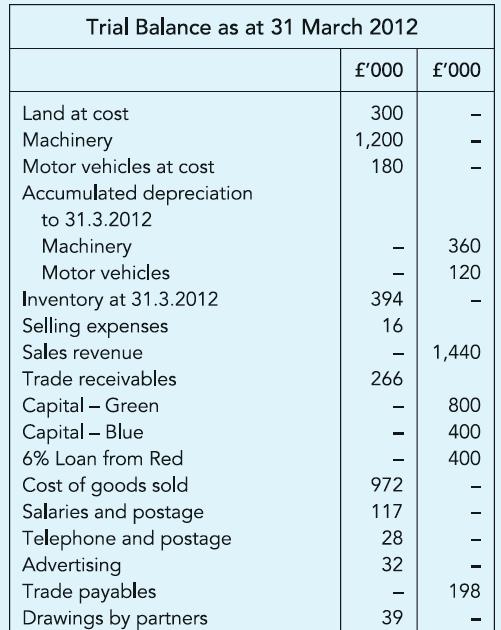

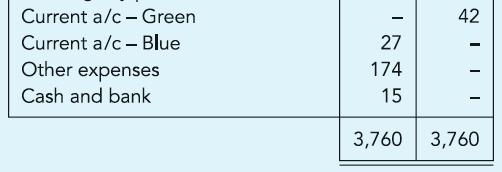

The year-end Trial Balance of the partnership is shown. You are further informed as follows:

(i) Salary drawn by Green, regularly on the last day of each month, is included in the Salaries account.

(ii) Interest paid on Red’s loan, until his admission to partnership, is included within Other expenses; while the salary drawn by him until that date is included in the Salaries account.

(iii) Reported in the Drawings account are the following:

■ £2,000 drawn regularly per month by Green.

■ £1,000 drawn regularly per month by Blue.

■ £1,000 per month drawn by Red after 1.1.2012.

(iv) Assume that income and expenses, unless indicated otherwise, accrued consistently throughout the year.

Required:

The Statement of income for the year ended 31 March 2012 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict