Rose and Ivy, sharing profits in the ratio 2:1 respectively, and finalising annual accounts on 31 December,

Question:

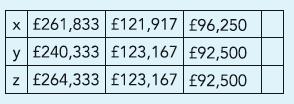

Rose and Ivy, sharing profits in the ratio 2:1 respectively, and finalising annual accounts on 31 December, admit Liby for a fourth share of profit on 1 March 2012. Until Liby’s admission the balances in the Capital accounts of Rose and Ivy were £300,000 and £200,000 respectively. Liby introduced £200,000 as capital. Their partnership agreement provides for a salary to Rose of £2,000 per month and interest on capital at 6% per annum. Apart from the adjustment to the profit-sharing ratio other terms of the agreement are to continue after the admission of Liby. Profit for the year ended 31 December 2012 was £480,000 and it may be assumed to have accrued consistently throughout the year. Identify the share of profit each partner would be entitled to in each of the following alternative scenarios:

(a) If goodwill, not appearing in the books, is valued on Liby’s admission at £300,000 and is to be recorded in the books

(b) If goodwill, not appearing in the books, is valued on Liby’s admission at £300,000, and should be adjusted for, but is not to appear in the books

(c) If goodwill, reported already in the books at £120,000, is valued at £300,000 on the date of Liby’s admission and is to be reported in the books at the new value

(d) If goodwill, reported in the books at £120,000, is valued on Liby’s admission at £300,000. However, the partners have decided that goodwill should not appear in the books

(e) On the date of Liby’s admission, non-current assets reported at £400,000 had a fair value of £760,000 and goodwill not recorded in the books is valued at £300,000. The partners have decided to report non-current assets at their fair value but not to record goodwill in the books

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict