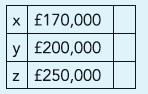

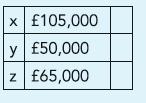

The Statement of financial position as at 30 June 2012, of Green and Amber, equal partners, appear

Question:

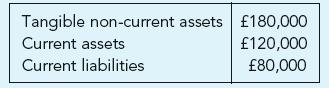

The Statement of financial position as at 30 June 2012, of Green and Amber, equal partners, appear as on the right. Current assets include £30,000 cash. Colourlights Ltd acquired the partnership on this date as a going concern. The total of the Capital and Current account balances of Green and Amber, on this date, were £150,000 and £70,000 respectively.

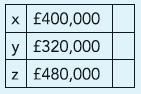

(a) If goodwill was valued at £50,000, while tangible non-current assets and current assets were valued at £240,000 and £110,000 respectively, what is the purchase consideration receivable by the partners from Colourlights?

(b) If the current liabilities of the partnership included a bank overdraft of £26,000 which is not taken over, goodwill was valued at £60,000, while tangible non-current assets and current assets were valued at £220,000 and £100,000 respectively, what is the purchase consideration receivable by the partners from Colourlights?

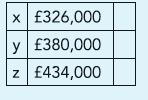

(c) If Colourlights agreed to discharge the purchase consideration by an allotment to Green and Amber, in their profit-sharing ratio, of 300,000 ordinary shares of £1 each at 120p each and a payment of £40,000 in cash, how much would Colourlights be paying for the partnership goodwill, assuming that all assets were taken over at book value?

(c) If Colourlights agreed to discharge the purchase consideration by an allotment to Green and Amber, in their profit-sharing ratio, of 300,000 ordinary shares of £1 each at 120p each and a payment of £40,000 in cash, how much would Colourlights be paying for the partnership goodwill, assuming that all assets were taken over at book value?

(d) If Colourlights valued the tangible non-current assets of the partnership at £240,000 and agreed to discharge the purchase consideration by an allotment equally to both partners of 800,000 ordinary shares of 50p each, at 60p per share, and an issue to Amber of £50,000 6% Loan notes, how much would have been paid for goodwill?

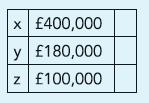

(e) If Colourlights valued the tangible non-current assets at £300,000 and as purchase consideration agreed to allot equally to both partners one million ordinary shares of 20p each at 25p per share and in addition pay £50,000, how much will Green receive in cash when the dissolution of the partnership is completed?

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict