Rosy, Serah and Terese carried on a business in partnership, sharing profits in the ratio 2:1:1 respectively,

Question:

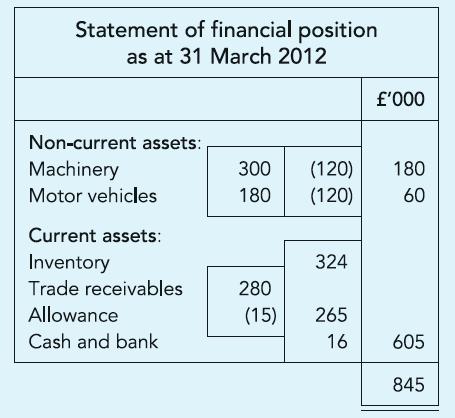

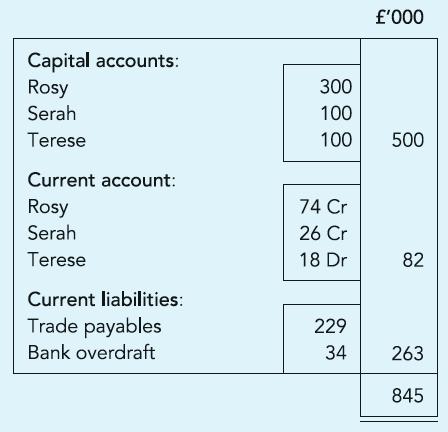

Rosy, Serah and Terese carried on a business in partnership, sharing profits in the ratio 2:1:1 respectively, and their Statement of financial position on 31 March 2012 was prepared as shown. They decided to convert their business into a limited company from that date, on the following basis:

(a) Rosy would take over at a value of £10,000 the vehicle she had been using and take personal responsibility for the bank overdraft. The vehicle used by Rosy had been acquired by the partnership for £40,000 and depreciated by £8,000 as at the date of conversion.

(b) The limited company, named RST Ltd, will take over the machinery at a value of £200,000 and trade receivables subject to an Allowance for doubtful debts of 5%.

(c) The purchase consideration is to be discharged as follows:

(i) Allotment to Rosy, Serah and Terese, in their profitsharing ratio, of 500,000 ordinary shares of £1 each at 120p each.

(ii) Payment of £14,000 in cash.

Required:

(a) Set out the Realisation account, the Cash account and the partners’ Capital accounts, recording the closure of the partnership books, assuming the cash adjustments were made among the partners.

(b) Set out the Statement of financial position of RST Ltd, as soon as it was opened.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict