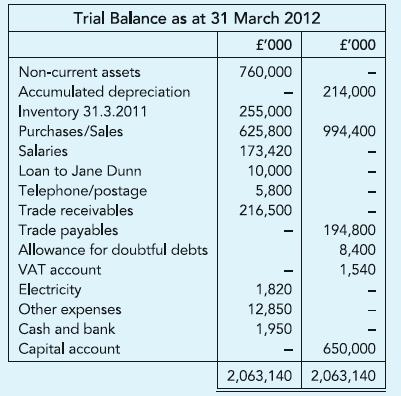

Ryan, registered for VAT, extracted the year-end Trial Balance as shown. He informs you that: (a) The

Question:

Ryan, registered for VAT, extracted the year-end Trial Balance as shown. He informs you that:

(a) The following invoices relating to the period are yet to be accounted for: £29,140 from supplier of goods for sale already delivered £235 for telephone calls up to 31 March 2013.

(b) Unsold goods in hand at year-end, at cost inclusive of VAT, amounted to £334,875.

(c) The £10,000 Loan given to Jane Dunn, the sales manager, is being recovered from her pay in 20 equal instalments from May 2011.

(d) The salaries account includes only the net salary paid and amounts remitted to HMRC, £15,800 as PAYE and £14,860 as National Insurance. PAYE is deducted at 10% and employees’ contribution to National Insurance at 6%. The employer’s contribution is 9%.

(e) A trade debt of £23,500 is to be written off and the allowance for doubtful debts adjusted to 4% of trade receivables.

(f) Non-current assets are depreciated at 10% per annum using the reducing balance method.

(g) VAT rate is 17.5%.

Required: The financial statements for the year ended 31 March 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict