On January 1, 2015, Drummond Oil and Gas Company was about to embark on a 50-well exploration

Question:

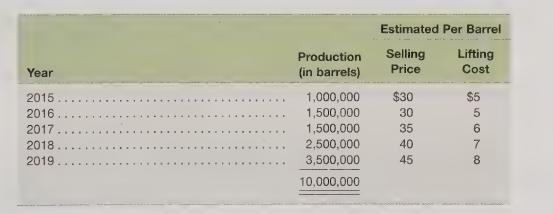

On January 1, 2015, Drummond Oil and Gas Company was about to embark on a 50-well exploration program in Texas and Louisiana. The CEO estimated that the average cost to drill a well would run \($800,000\) per well, with a resulting success ratio of 60 percent (30 wells were expected to yield commercially viable quantities of oil while 20 wells were expected to be commercially unproductive). In aggregate, the CEO estimated that the 30 successful wells would yield ten million barrels of oil, to be extracted at the following rates.

The CEO of Drummond Oil and Gas Company was concerned about how the accounting for the exploration project would affect the firm’s overall reported results. The exploration program would be financed with a \($40\) million bank loan acquired on January 1, 2015 with an interest rate of 10 percent per year on the balance of the loan outstanding as of the beginning of the year. The loan would be repaid in four installments of \($10\) million per year, with the first payment occurring on December 31, 2016.

Required

Assume that this is the company’s only exploration project. Prepare the firm’s income statements and balance sheets for 2015 through 2019 assuming the use of:

1. The full cost method 2. The successful efforts method

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris