Refer to the Simon Company information in Exercises 13-6 and 13-8. Compare the companys long-term risk and

Question:

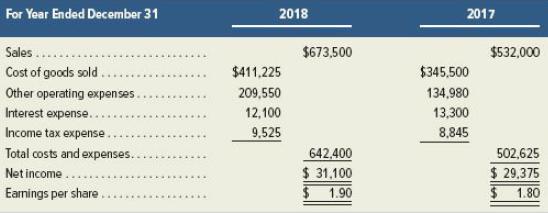

Refer to the Simon Company information in Exercises 13-6 and 13-8. Compare the company’s long-term risk and capital structure positions at the end of 2018 and 2017 by computing these ratios:

(1) Debt and equity ratios—percent rounded to one decimal,

(2) Debt-to-equity ratio—rounded to two decimals,

(3) Times interest earned—rounded to one decimal. Comment on these ratio results.

Exercises 13-6

Exercises 13-8

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild

Question Posted: