Operating profit margins The following extracts show the different ways in which three companies report their operating

Question:

Operating profit margins

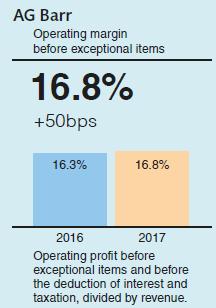

The following extracts show the different ways in which three companies report their operating profit margins (operating profit as a percentage of sales). This ratio is an indicator of the performance of the business, or segments of the business. It provides useful information for investors, but may also help competitors.

Halfords

Summary of Group results

Revenue of £1,095.0m was up 7.2%, with like-for-like (“LFL”)* growth of 2.7%. Gross margin of 51.0% was 220 basis points (bps) lower than the prior year, predominantly due to the impact of the movement in foreign currency exchange rates. Total operating costs before nonrecurring items rose by 5.0% reflecting planned investments for the Moving Up A Gear strategy and the first-time inclusion of the operating expenditure in respect of the acquired Tredz and Wheelies businesses.

Group revenue in FY17, at £1,095.0m, was up 7.2% and comprised Retail revenue of £938.4m and Autocentres revenue of £156.6m. This compared to FY16 Group revenue of £1,021.5m, which comprised Retail revenue of £868.5m and Autocentres revenue of £153.0m.

Group gross profit at £558.6m (FY16: £543.1m) represented 51.0% of Group revenue (FY16: 53.2%), reflecting a decrease in the Retail gross margin of 260 “bps” to 48.6% partially offset by an increase in the Autocentres gross margin of 80 bps to 65.1%.

Greggs Operating margin

Operating margin before exceptional items was 9.0% (2015: 8.7%).

Including exceptional items operating margin was 8.4% (2015: 8.7%).

Within this, gross margin before exceptional items increased to 63.7%

(2015: 63.5%) reflecting benign input cost conditions for most of the year, although these became inflationary in the fourth quarter. Including exceptional items gross margin was 63.2% (2015: 63.5%).

We continue to see savings from our actions to make the business simpler and more efficient. In 2016 we delivered savings of £7.1 million, slightly ahead of the targets we had set. Benefits were achieved through better procurement and as a result of investments made to simplify our operations across retail and supply chain. In 2017 we expect to make a similar level of progress as we see initial benefits from our supply chain restructuring and continue to invest in improved processes and systems.

Discussion points

1. AG Barr is a manufacturer of soft drinks, Halfords and Greggs are chains of retail stores selling different products. What do you learn about the profitability of these different kinds of business?

2. All three companies report ‘margins’ but there is no standard terminology for describing profit margins.

How many different descriptions are used? Can the figures be compared directly?

Step by Step Answer: