Thames Water plc Thames Water is one of ten regional licensed and regulated companies providing water and

Question:

Thames Water plc

Thames Water is one of ten regional licensed and regulated companies providing water and wastewater services in England and Wales. With 15 million customers we serve about 25% of the population of England and Wales.

Dividends

The Company’s dividend policy is to pay a progressive dividend commensurate with the long-term returns and performance of the business, after considering the business’s current and expected regulatory and financial performance, regulatory restrictions, management of economic risks and debt covenants. Directors, in assessing the dividend to be paid (to a maximum of statutory distributable reserves), are required to ensure that:

- sufficient liquidity is maintained to enable the business to meet its financial obligations for at least 15 months;

- the Company maintains a minimum of 2% headroom on its Regulated Asset Ratio covenant restrictions

- post-dividend financial ratios remain within their agreed limits at both the balance sheet date and on a forward-looking basis.

The Company paid dividends totalling £157million during the financial year 2016/17 (2015/16: £82.4million).

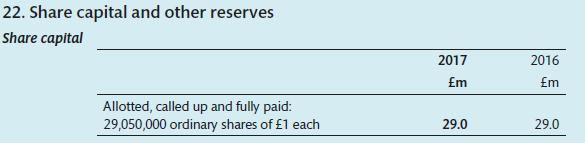

The Company has one class of ordinary share which carries no right to fixed income. The holders of ordinary shares are entitled to receive dividends as declared and are entitled to one vote per share at meetings of the Company.

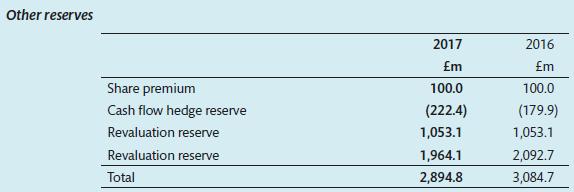

The revaluation reserve reflects the revaluation of infrastructure assets to fair value on transition to IFRS, net of deferred tax. The cash flow hedge reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedging instruments related to hedged transactions that have not yet occurred.

Discussion points

1. How does the company explain the benefits of share capital for the holders?

2. How does the company explain its dividend policy? What restrictions apply because it is a regulated provider of water services?

3. In the chapter you will find explanations for share premium, revaluation reserve and retained earnings.

The cash flow hedge reserve is a temporary location for transactions that will flow through retained earnings later. Is there sufficient explanation in the extract for shareholders to understand the nature of the reserves?

Step by Step Answer: