This exercise tests your understanding of all aspects of accounting learned till the end of Chapter 12

Question:

This exercise tests your understanding of all aspects of accounting learned till the end of Chapter 12 and tests your ability to use an accounting equation spreadsheet for recording the transactions of a limited company

Information about the business

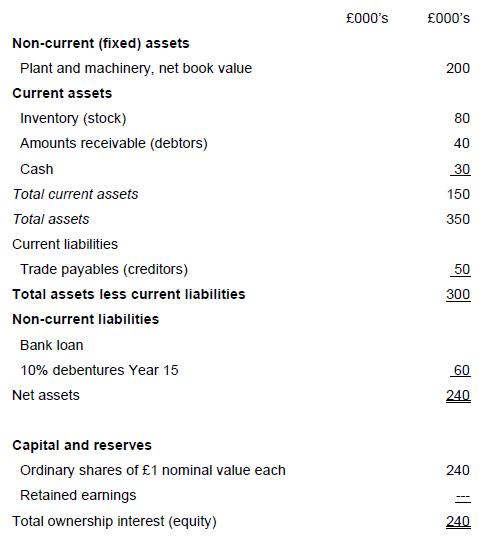

The opening statement of financial position (balance sheet) of Saltire Engineering Ltd on 1 January Year 4 is as follows.

Statement of financial position (balance sheet) at 1 January Year 4

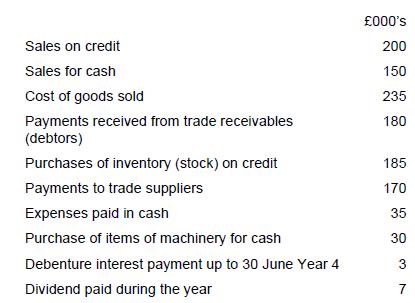

The following transactions were undertaken by Saltire Engineering Ltd in the year ended 31 December Year 4:

The company accountant has noted the following matters that are not reflected in the list of transactions for the year and so require adjustments to be made at the year-end:

(i) Depreciation should be charged at the rate of 15 per cent per annum on all items of plant and machinery.

(ii) Items held in inventory (stock) at the year-end that originally cost £5,000 are judged to have a net selling price of £3,000.

(iii) Accrue the final six-month debenture interest obligation.

(iv) Tax on the profits for the year to 31 December Year 4 is estimated at £9,000.

Required:

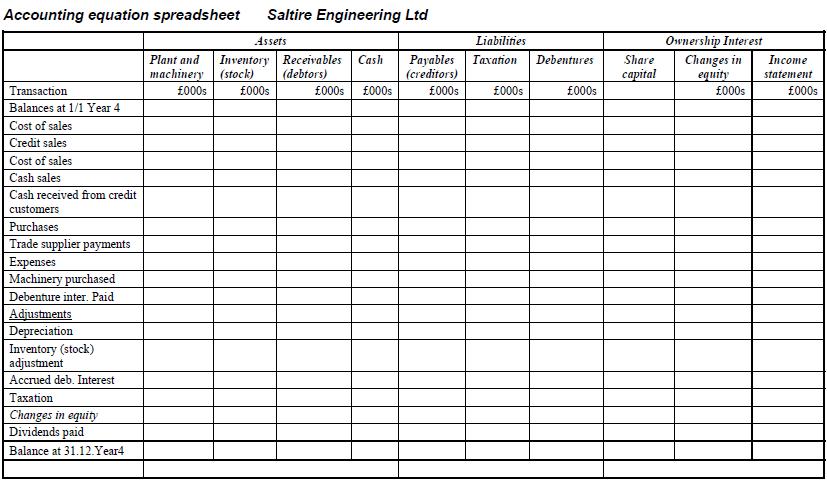

(a) Use the accounting equation spreadsheet to record the effect of the above transactions and adjustments with respect to Saltire Engineering for the year ended 31 December Year 4.

(b) From the spreadsheet, prepare an income statement (profit and loss account) and statement of financial position (balance sheet) of Saltire Engineering Ltd with respect to the year ended 31 December Year 4.

Step by Step Answer: