This exercise tests your understanding of all aspects of accounting learned till the end of Chapter 12

Question:

This exercise tests your understanding of all aspects of accounting learned till the end of Chapter 12 and tests your ability to use an accounting equation spreadsheet for recording the transactions of a limited company.

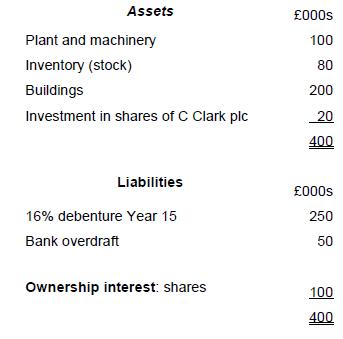

Information about the business

The following is a list of assets, liabilities and ownership interest of D. James Ltd on 1 January Year 5 when the company began to trade.

The company has an issued share capital of 100,000 £1 ordinary shares.

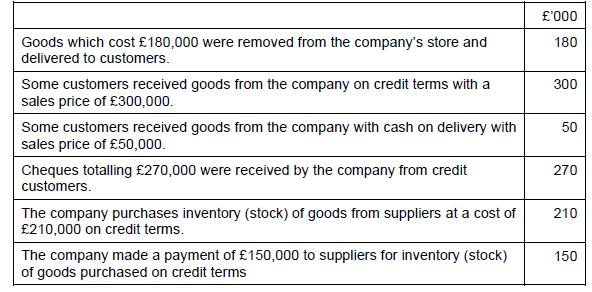

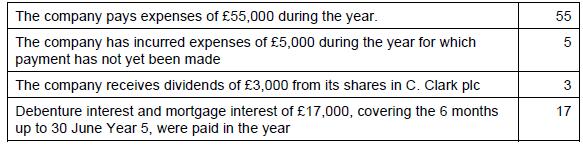

The following transactions were undertaken by D. James Ltd in the year ended 31 December Year 5.

The following adjustments should be made at the year-end.

(i) Depreciation for the year should be calculated at the rate of 10 per cent per annum on plant and machinery and at the rate of 2 percent per year on buildings.

(ii) Debenture and mortgage interest for the 6 months to 31 December Year 5 should be accrued.

(iii) Some items of inventory (stock) held at 31 December Year 5 that originally cost £30,000 are found to have a net selling price of £15,000 due to obsolescence.

(iv) Tax on the profit for the year to 31 December Year 5 has been estimated at £13,000.

Required:

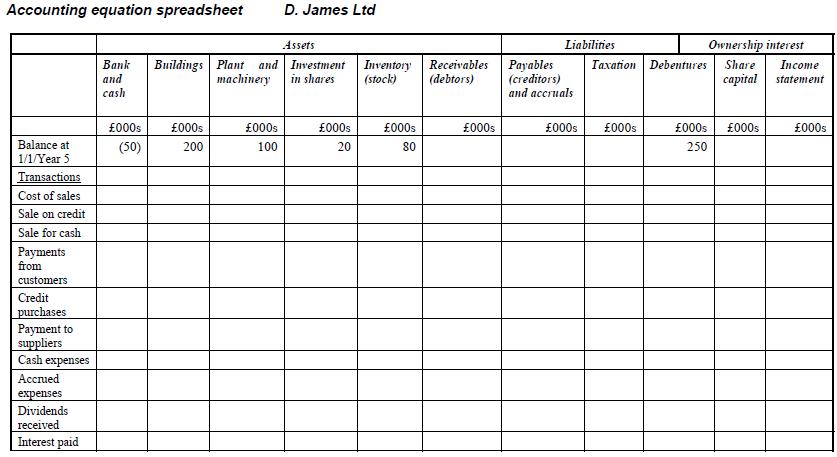

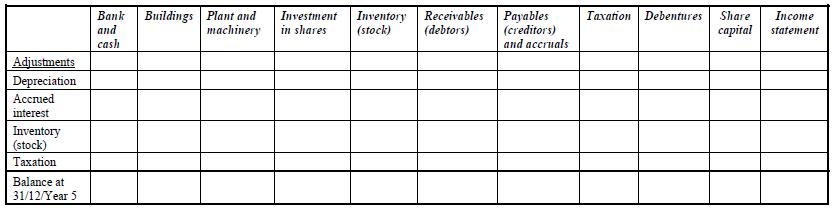

(a) Use the accounting equation spreadsheet to record the effect of the above transactions and adjustments with respect to D. James Ltd for the year ended 31 December Year 5.

(b) From the spreadsheet, prepare a statement of financial position (balance sheet) for D. James Ltd as at 31 December Year 5.

Step by Step Answer: