A recent annual report for Delta Air Lines included the following note: Assume that Delta made extensive

Question:

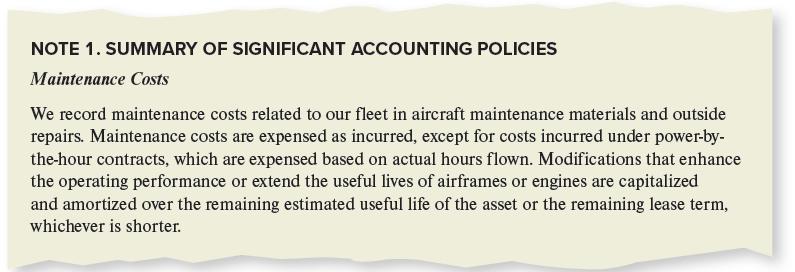

A recent annual report for Delta Air Lines included the following note:

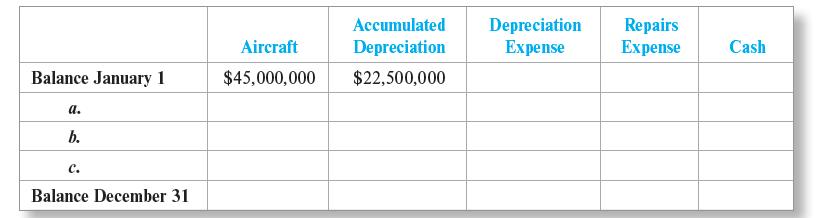

Assume that Delta made extensive repairs on an airplane engine, increasing the fuel efficiency and extending the useful life of the airplane. The existing airplane originally cost $45,000,000, and by the end of last year, it was half depreciated based on use of the straight-line method, a 20-year estimated useful life, and no residual value. During the current year, the following transactions related to the airplane were made:

a. Ordinary repairs and maintenance expenditures for the year, $7,000,000 cash.

b. Extensive and major repairs to the airplane’s engine, $2,700,000 cash. These repairs were completed at the end of the current year.

c. Recorded depreciation for the current year.

Required:

1. Applying the policies of Delta, complete the following, indicating the effects for the preceding expenditures for the current year. If there is no effect on an account, write NE on the line.

2. What was the net book value of the aircraft on December 31 of the current year?

3. Explain the effect of depreciation on cash flows.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge