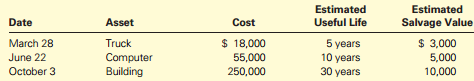

During 2014, Carter Company acquired three assets with the following costs, estimated useful lives, and estimated salvage

Question:

The company uses the straight-line method to depreciate all assets and computes deprecia-tion to the nearest month. For example, the computer system will be depreciated for six months in 2014.

Required

1. Compute the depreciation expense that Carter will record on each of the three assets for 2014.

2. Comment on the following statement: Accountants could save time and money by simply expensing the cost of long-term assets when they are purchased. In addition, this would be more accurate because depreciation requires estimates of useful life and salvage value.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: