Question: Suppose that La-Z-Boy in E27 signed a debt covenant specifying that current assets must exceed current liabilities by $200 million. Assume further that in early

Data from E2-7

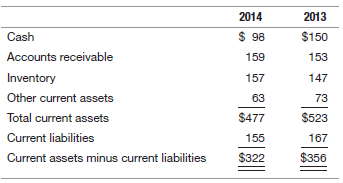

La-Z-Boy Incorporated included the following information in its 2014 annual report (dollars in millions).

2014 2013 $ 98 $150 Cash Accounts receivable 159 153 Inventory 157 147 Other current assets 63 73 $477 $523 Total current assets Current liabilities 155 167 $322 $356 Current assets minus current liabilities

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Method 1 Method 2 Working capital as of 12312014 3... View full answer

Get step-by-step solutions from verified subject matter experts