Better Yet Dishware produces dishes and drinking mugs for a large domestic market. It uses both traditional

Question:

Better Yet Dishware produces dishes and drinking mugs for a large domestic market. It uses both traditional retail outlets and its own company stores where slightly flawed product is sold. Decorating the dishes is done by hand, while the entire production process for drinking mugs is automated.

John Kluny, president of Better Yet, has recently been concerned with the costs of making dishware vs. coffee mugs. The cost of the products used to be roughly comparable until the huge mug making machine was put in place last year. The mug-making machine cost the company $2,500,000 and is supposed to last five years with two shift-a-day operations. Other costs caused by running the machine add up to $250,000 per year, including the space, power, and insurance it requires. Only one direct labor worker is needed to run the machine. In the past, it took 15 people to make the mugs. Dishware is a larger department, but it only uses machines to form the dishes. This machine is old and fully depreciated. The rest of the cost in the department is related to labor. More than 50 people work in the dishware department, hand-painting each set as it comes down the production line.

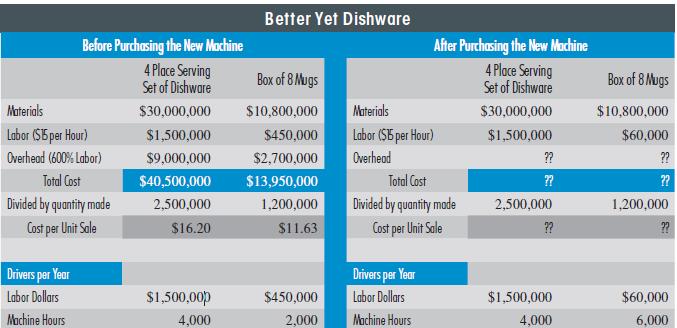

The following table summarizes the material, labor and overhead costs, and activity drivers for the two departments before and after the new machine was put in place.

The new overhead rate had yet to be determined. Overhead costs in total, however, have gone up by the cost of the new machine. John has asked you to help him better understand his costs. You have gladly volunteered and decide to follow the steps below.

REQUIRED:

a. Develop an estimate of the new total amount of Better Yet’s overhead.

b. Using direct labor dollars and a plant-wide rate, recalculate the overhead charged to each product and the cost per sales unit for each of the products.

c. Now develop two overhead rates. Specifically, assume that the overhead that was charged to the dishware department before the new mug-making machine was purchased was about right. Take the rest of the newly calculated overhead from (a) and charge it to mug-making. Continue to charge overhead out in dishware by using direct labor dollars. Create a new rate for mug-making using machine hours as your driver.

d. What are your product costs now? Which approach is better? Why?

e. Do you think it was a good idea to purchase the new machine? Why or why not?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant