It is the policy of Seaton Ltd to make provision for doubtful debts at a rate of

Question:

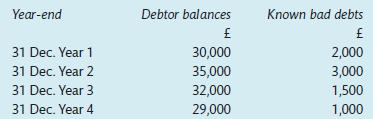

It is the policy of Seaton Ltd to make provision for doubtful debts at a rate of 10% per annum on all debtor balances at the end of the year, after deducting any known bad debts at the same date. The following table sets out the total receivables (debtors) as shown by the accounting records and known bad debts to be deducted from that total. There is no provision at 31 December Year 0.

Required

(a). Calculate the total expense in the income statement (profit and loss account) in respect of bad and doubtful debts.

(b). Set out the statement of financial position (balance sheet) information in respect of receivables (debtors) and provision for doubtful debts at each year-end.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Management Accounting An Introduction

ISBN: 9781292244419

8th Edition

Authors: Pauline Weetman

Question Posted: