Yankee Spices is a medium- sized manufacturer of a wide variety of spices sold into two main

Question:

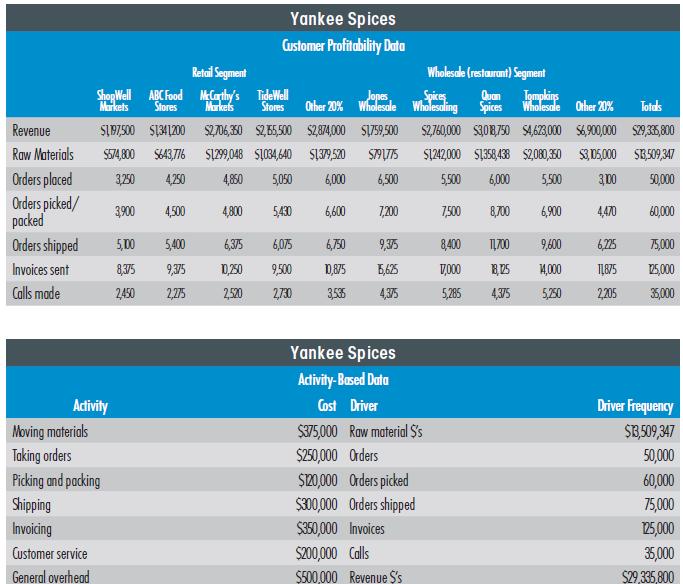

Yankee Spices is a medium- sized manufacturer of a wide variety of spices sold into two main segments of the market : direct to grocery store chains and to restaurants through a wholesaler network. The size of the bottle of spices is the main difference in the two markets, with larger containers made of plastic used for restaurants, and smaller bottles made of glass for the retail market. While prices vary for a bottle of spices, the average price is $4.79 for the retail market and $17.25 for the wholesale market. In each segment, Yankee Spices has four major customers that account for 80% of its sales and then a collection of smaller customers that make up the remaining 20% of its sales. The operating costs for the retail segment are $2,750,000 with an asset base of $7,500,000. The operating costs for the wholesale segment are $4,800,000 with an asset base of $10,400,000.

The two spice segments combine to make up the spice division of the parent company. The spice division’s operating costs are $4,575,000 per year with a total asset base of $20,600,000. The company has adopted activity-based costing (ABC) for its customer analysis. The data the company makes available to you is in the table below.

REQUIRED:

a. Do a customer profitability analysis using the ABC data to derive the non materials costs for each customer.

b. Given the results of your customer profitability analysis, complete the segment profitability analyses. This should include an ROA calculation.

c. Given the results of your segment profitability analysis, complete the profitability analysis for the division. This should include an ROA calculation.

d. What does this information tell you about the spices division? Is it making a sufficient ROA?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant