Best Buy is a leading provider of technology products, services, and solutions. The following selected information is

Question:

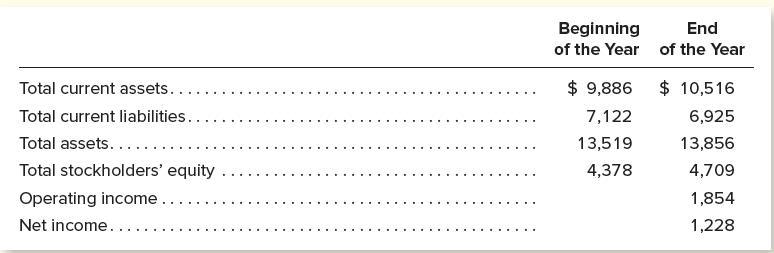

Best Buy is a leading provider of technology products, services, and solutions. The following selected information is adapted from the company’s January 28, 2017, annual report. (Dollar amounts are stated in millions.)

The company has long-term liabilities that bear interest at annual rates ranging from 6 percent to 8 percent.

Instructions

a. Compute the company’s current ratio at (1) the beginning of the year and (2) the end of the year. (Carry to two decimal places.)

b. Compute the company’s working capital at (1) the beginning of the year and (2) the end of the year. (Express dollar amounts in thousands.)

c. Is the company’s short-term debt-paying ability improving or deteriorating?

d. Compute the company’s (1) return on average total assets and (2) return on average stockholders’ equity. (Round average assets and average equity to the nearest dollar and final computations to the nearest 1 percent.)

e. As an equity investor, do you think that Best Buy’s management is utilizing the company’s resources in a reasonably efficient manner? Explain.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello