Averna plc is a research-based engineering business that has recently developed an electric scooter operated by solar

Question:

Averna plc is a research-based engineering business that has recently developed an electric scooter operated by solar batteries. The technology employed is highly sophisticated and so the scooter is expected to have a production life cycle of four years. Research and development costs to date have amounted to £10.5 million.

To exploit the potential of the new product, Averna plc has two possible options.

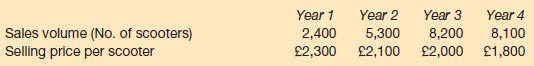

1. It could manufacture the scooters and then sell them through a major distributor of cars and scooters. Scooter production would begin almost immediately and over the fouryear production life cycle, sales are forecast to be as follows:

million. The equipment would have no further use at the end of the four-year period and could be sold for an estimated £3.2 million at that point.

An immediate injection of working capital of £2.8 million will be required, which would be released at the end of the production period. Estimated annual manufacturing fixed costs are £5.5 million and include an annual depreciation charge of £2.3 million. Variable costs are £400 per scooter. At the end of the four-year production period, the production staff will be laid off and redundancy costs of £1.4 million will be incurred.

2. Averna plc could allow Edusa Engineering Co to manufacture the scooter under licence.

It is expected that, under this option, sales volumes will be 10 per cent lower than the forecast figures shown above. The licence will provide for a royalty payment to be made to Averna plc of £250 per scooter. In addition, a further royalty payment of £2.5 million will be made to Averna plc at the end of the licence agreement. Averna plc will, however, provide an immediate interest-free loan to Edusa Engineering Co of £2.0 million for the four-year period, at the end of which it is repaid. Additional administration costs of £0.1 million per year will be incurred by Averna plc under this option in order to monitor the licensing agreement.

Averna plc is financed by a mixture of ordinary shares and loan notes. The ordinary shares have a beta of 1.4. Returns to the market are 8 per cent and the risk-free rate is 3 per cent. The loan notes are irredeemable and have a coupon rate of 4 per cent. They are currently being traded at £80 per £100 nominal value. The target capital structure of the business is 80 per cent ordinary shares and 20 per cent loan notes.

Ignore taxation.

Required:

(a) Calculate the net present value for each option.

(b) Briefly state any qualifications that you may wish to make concerning the validity of the calculations made in (a) above.

(c) On the basis of the information available, which option would you choose and why?

Step by Step Answer: