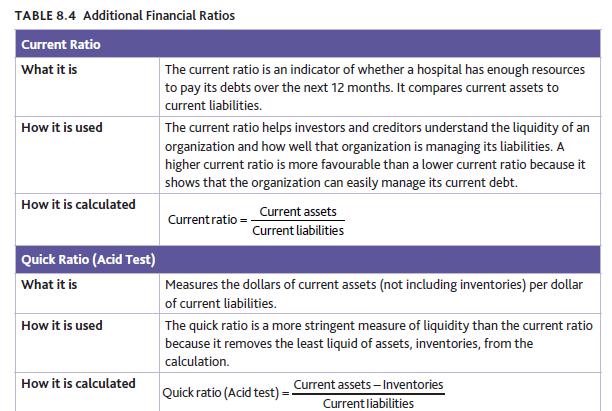

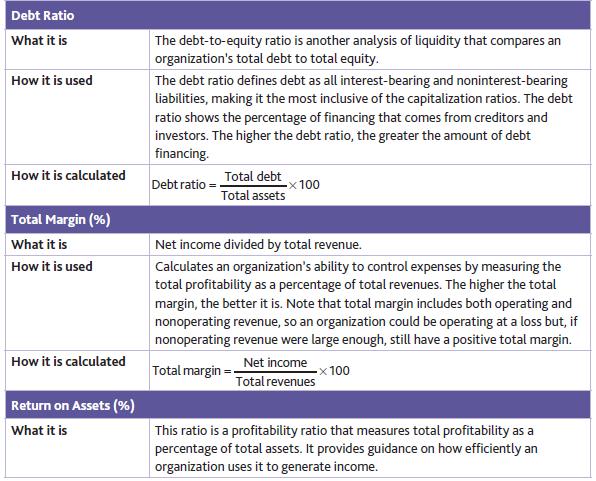

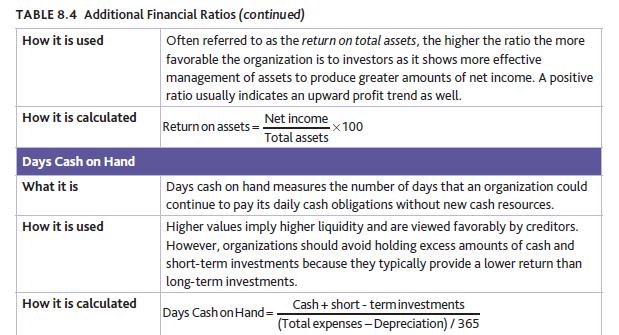

Question: Using the data in Table 8.1 and the definitions in Table 8.4, calculate the days cash on hand. a. What information does this financial ratio

Using the data in Table 8.1 and the definitions in Table 8.4, calculate the days cash on hand.

a. What information does this financial ratio provide?

b. If you were concerned about the result, what could be done to positively impact this ratio?

c. In what ways could this ratio be negatively impacted?

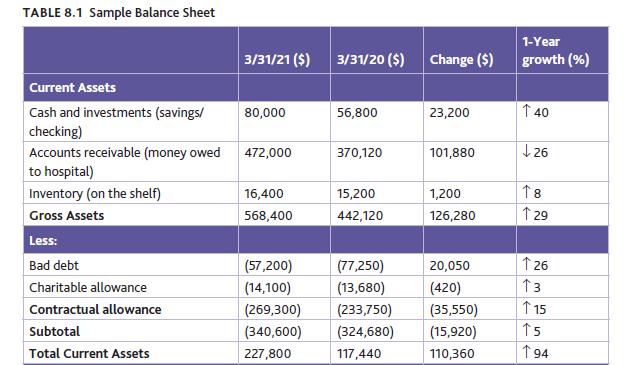

TABLE 8.1 Sample Balance Sheet Current Assets Cash and investments (savings/ checking) Accounts receivable (money owed to hospital) Inventory (on the shelf) Gross Assets Less: Bad debt Charitable allowance Contractual allowance Subtotal Total Current Assets 3/31/21 ($) 80,000 472,000 16,400 568,400 (57,200) (14,100) (269,300) (340,600) 227,800 3/31/20 ($) Change ($) 56,800 370,120 15,200 442,120 (77,250) (13,680) (233,750) (324,680) 117,440 23,200 101,880 1,200 126,280 20,050 (420) (35,550) (15,920) 110,360 1-Year growth (%) 40 26 18 129 126 13 115 15 194

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts