Question: Using the data in Table 8.1 and the definitions given in Table 8.4, calculate the current ratio, quick ratio, and the debt ratio. a. What

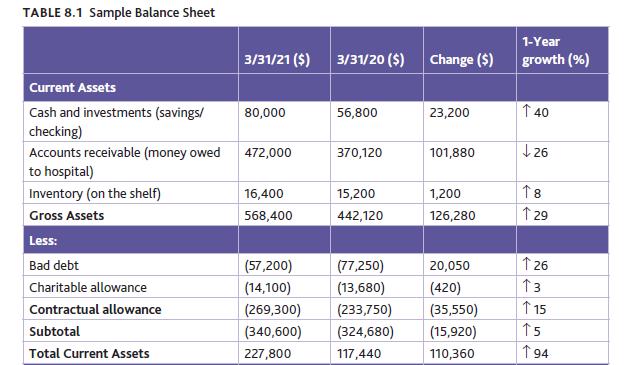

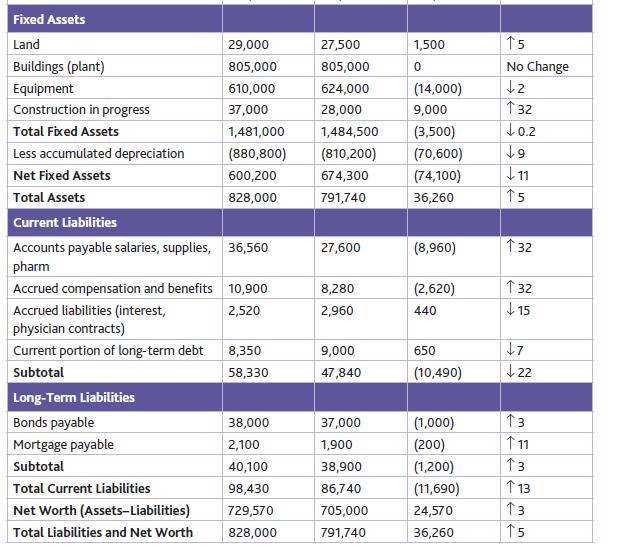

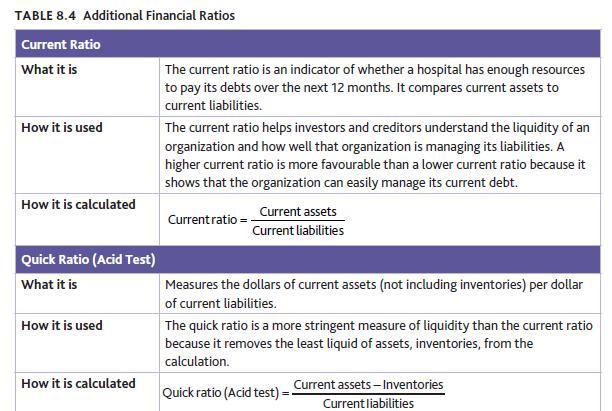

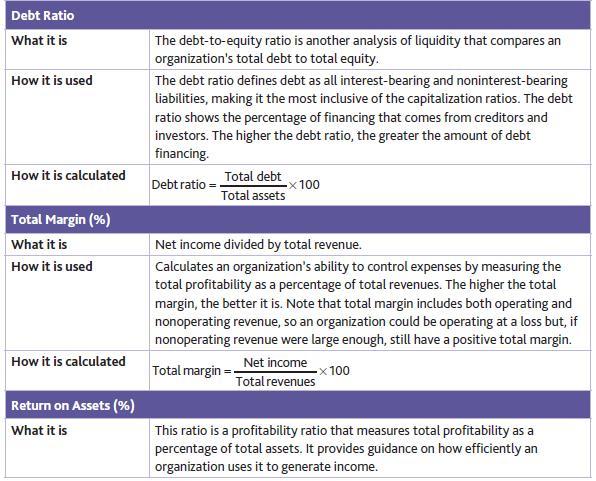

Using the data in Table 8.1 and the definitions given in Table 8.4, calculate the current ratio, quick ratio, and the debt ratio.

a. What information do these ratios provide?

b. If you were concerned about the result, what could be done to adjust these ratios?

c. In what ways could these ratios be negatively impacted?

d. When assessing the results of these ratios, what advice would you have for this organization if it was considering securing financing for a major capital expense?

TABLE 8.1 Sample Balance Sheet Current Assets Cash and investments (savings/ checking) Accounts receivable (money owed to hospital) Inventory (on the shelf) Gross Assets Less: Bad debt Charitable allowance Contractual allowance Subtotal Total Current Assets 3/31/21 ($) 80,000 472,000 16,400 568,400 (57,200) (14,100) (269,300) (340,600) 227,800 3/31/20 ($) Change ($) 56,800 370,120 15,200 442,120 (77,250) (13,680) (233,750) (324,680) 117,440 23,200 101,880 1,200 126,280 20,050 (420) (35,550) (15,920) 110,360 1-Year growth (%) 40 26 18 129 126 13 115 15 194

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts