Assume an organization could issue a zero coupon bond at an annual interest rate of 4 percent

Question:

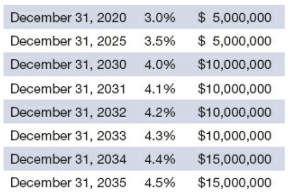

Assume an organization could issue a zero coupon bond at an annual interest rate of 4 percent with semiannual compounding for 20 years. If it receives $2,264.45 for the bond, how much would it have to pay at the maturity date? 6-20. On January 1, 2016, Central City issued a 20-year serial bond to finance improvements to the water distribution system. A total of $80,000,000 face value of bonds were issued with coupon and maturity rates as follows:

A. Solve using a spreadsheet program such as Excel.

B. Solve using a financial calculator.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management for Public, Health and Not-for-Profit Organizations

ISBN: 978-1506326849

5th edition

Authors: Steven A. Finkler, Daniel L. Smith, Thad D. Calabrese, Robert M. Purtell

Question Posted: