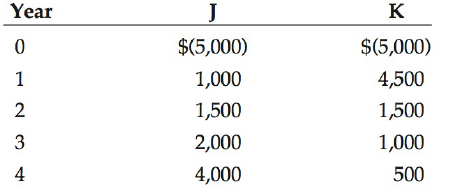

Your company is considering two mutually exclusive projects, J and K, whose costs and cash flows are

Question:

Your company is considering two mutually exclusive projects, J and K, whose costs and cash flows are shown below:

The projects are equally risky, and their cost of capital is 12%. You must make a recommendation, and you must base it on the modified IRR (MIRR). What is the MIRR of the better project?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Question Posted: