Vail Resorts, Inc. (MTN), announced a $415 million expansion of lodging properties, ski lifts, and terrain in

Question:

Vail Resorts, Inc. (MTN), announced a $415 million expansion of lodging properties, ski lifts, and terrain in Park City, Utah. Assume that this investment is estimated to produce $99 million in equal annual cash flows for each of the first 10 years of the project life.

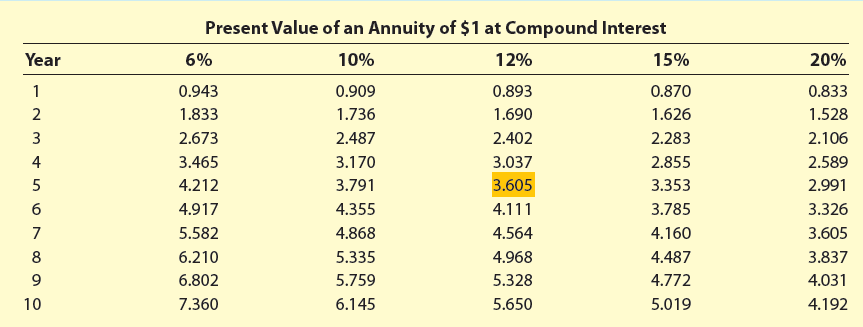

a. Determine the expected internal rate of return of this project for 10 years, using the present value of an annuity table appearing in Exhibit 5 of this chapter.

b. What are some uncertainties that could reduce the internal rate of return of this project?

Exhibit 5:

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Question Posted: