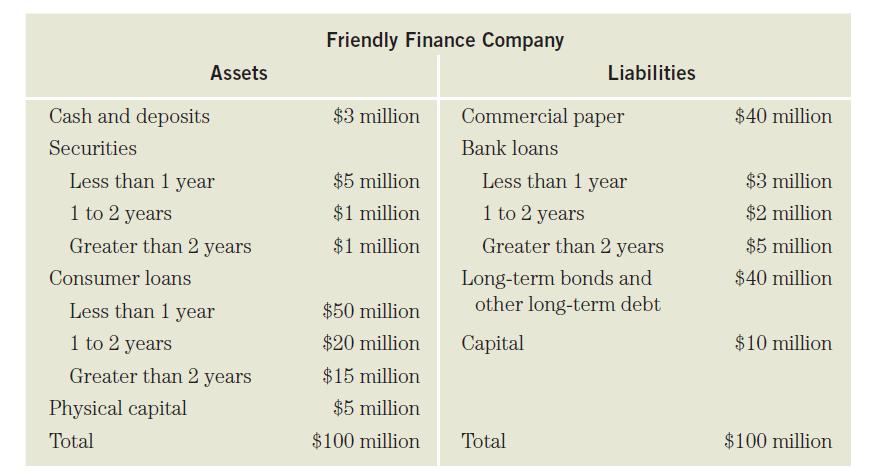

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that

Question:

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that interest rates are initially at 8%.

If the Friendly Finance Company raises an additional $20 million with commercial paper and uses the funds to make $20 million of consumer loans that mature in less than one year, what happens to its interestrate risk? In this situation, what additional changes could it make in its balance sheet to eliminate the income gap?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: