A bond portfolio consists of two bonds: A zero-coupon bond maturing in three years and a coupon

Question:

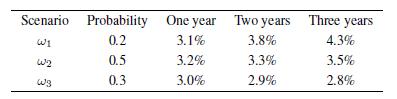

A bond portfolio consists of two bonds: A zero-coupon bond maturing in three years and a coupon bond with a single (annual) coupon of \(4 \%\), maturing in two years. Both bonds have a face value of \(€ 1000\), and we hold 10 bonds of the first kind and 20 of the second one. Interest rates are subject to uncertainty, and we consider the following three term structure scenarios:

The three scenarios consist of annually compounded spot rates for maturities of 1,2 , and 3 years (note that, in general, making sure that scenarios are realistic and arbitrage-free is not trivial). We neglect the passage of time, i.e., we assume that these scenarios apply to the immediate future and are based on an instantaneous change in the term structure. Find the expected value of the portfolio wealth after the realization of the random scenario.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte