A pension fund manager has chosen a portfolio consisting of the risk-free asset, with annual return 3%

Question:

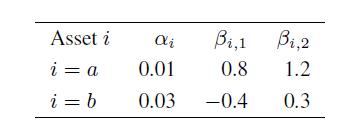

A pension fund manager has chosen a portfolio consisting of the risk-free asset, with annual return 3% (annual compounding), and two risky assets. The holding period return can be expressed by the following factor model:

![]()

with the following parameters:

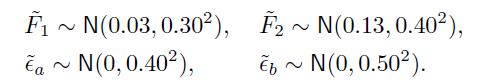

All factors are normally distributed with the following parameters:

Each specific risk factor is uncorrelated with the other factors, whereas the correlation coefficient between the two systematic factors is 0.68 . The portfolio weight of the risk-free asset is \(40 \%\), and the rest of the portfolio is equally allocated to the risky assets. The manager receives a bonus depending on the realized annual return: if it is at least \(9 \%\), the bonus is \(€ 200,000\); if the return exceeds \(12 \%\), she will receive additional \(€ 100,000\). What is the expected value of the bonus earned by the manager?

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte