You have estimated the following single-index model for two asset returns: where , and are uncorrelated random

Question:

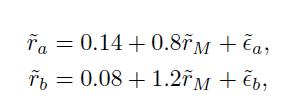

You have estimated the following single-index model for two asset returns:

where ![]() , and

, and ![]() are uncorrelated random variables with zero expected value (the expected value of the market return has been included into the constant term of the regression) and standard deviations \(20 \%, 30 \%\), and \(25 \%\), respectively. The model is expressed in terms of returns, not excess returns. Find the weights of the minimum variance portfolio (we are only considering risky assets, not the risk-free asset).

are uncorrelated random variables with zero expected value (the expected value of the market return has been included into the constant term of the regression) and standard deviations \(20 \%, 30 \%\), and \(25 \%\), respectively. The model is expressed in terms of returns, not excess returns. Find the weights of the minimum variance portfolio (we are only considering risky assets, not the risk-free asset).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: