A swap was agreed in the past, with swap rate (K_{2}=6 %) and a notional of ($

Question:

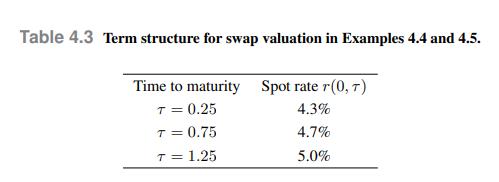

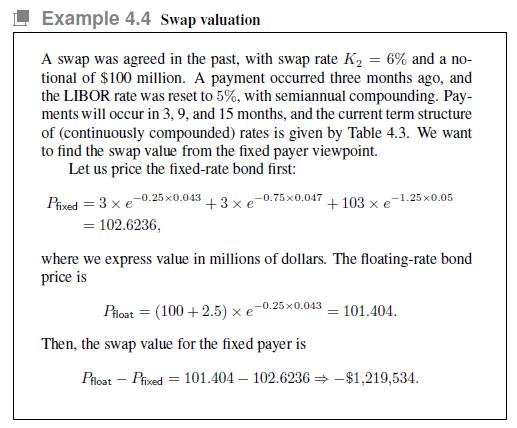

A swap was agreed in the past, with swap rate \(K_{2}=6 \%\) and a notional of \(\$ 100\) million. A payment occurred three months ago, and the LIBOR rate was reset to \(5 \%\), with semiannual compounding. Payments will occur in 3, 9, and 15 months, and the current term structure of (continuously compounded) rates is given by Table 4.3. We want to find the swap value from the fixed payer viewpoint.

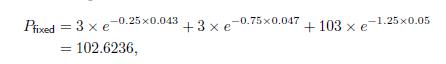

Let us price the fixed-rate bond first:

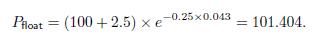

where we express value in millions of dollars. The floating-rate bond price is

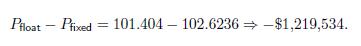

Then, the swap value for the fixed payer is

Data From Table 4.3

Data From Table 4.3

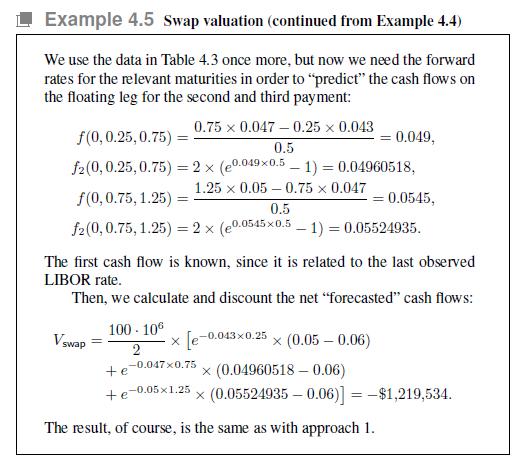

Data From Example 4.4

Data From Example 4.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: