A well-known factor model is the three-factor Fama-French model [2]. The model extends the single-index model, based

Question:

A well-known factor model is the three-factor Fama-French model

[2]. The model extends the single-index model, based on market risk, by introducing two additional factors related to the company size and the company book-to-market ratio. Company size takes into account the empirical difference in return between small and large capitalization firms. The book-to-market ratio takes into account the difference between value and growth stocks. Value stocks are characterized by a high book-to-market ratio, i.e., the market price is small with respect to the book value of the firm, which suggests that the stock is underpriced. Value investing is a strategy based on investing on stock shares which are expected to outperform the market if their market value approaches their intrinsic value. Growth stocks are not cheap, but the rationale of investing in a growth stock is that the firm has a sustainable competitive advantage and is able to generate increasing cash flows over time.

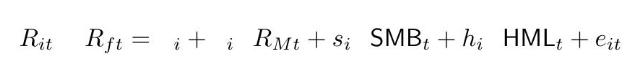

The regression model is specified as follows:

where \(R_{i t}\) is the return on asset \(i\) in month \(t, R_{f t}\) and \(R_{M t}\) are the corresponding risk-free return and market return, respectively, \(\mathrm{SMB}_{t}\) (small minus big) is the difference in return between diversified portfolios consisting of small and big cap stocks, and \(\mathrm{HML}_{t}\) (high minus low) is the difference in return between diversified portfolios consisting of high and low book-to-market stocks.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte