A market-neutral portfolio is a portfolio which is not exposed to systematic risk. The only source of

Question:

A market-neutral portfolio is a portfolio which is not exposed to systematic risk. The only source of return is specific risk. Such a portfolio is also referred to as beta-neutral, since its betas with respect to systematic risk factors are zero. A possible rationale behind such a portfolio is that we may have a view about the relative performance of stock shares, but we do not feel safe in making a bet on the direction of the market as a whole. The analysis may suggest that some stocks have positive alpha, and other stocks have negative alpha. However, investing in the positive alpha stocks may still result in a loss if the market takes a negative turn. We might find only a partial consolation in a portfolio losing less than the index. Thus, we may take a long-short strategy, whereby we short-sell the stocks with negative alpha in order to neutralize the overall beta, i.e., the exposure to portfolio risk.

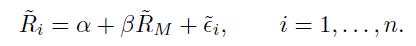

Let us consider a stylized example of the strategy. We have a subset of \(n\) assets, characterized by the single-index model

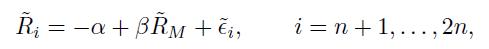

We assume that \(>0\) and are the same for all of these assets. We also have another subset of \(n\) assets, characterized by the single-index model

where again we assume that the numerical values of the involved parameters are the same and identical to those of the first subset of as-

sets. Note that the assets in the second set have negative alpha and, as such, are natural candidates for short-selling.

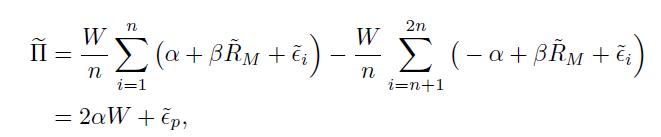

Imagine that we go long for a total amount of \(\$ W\) in an equally weighted portfolio of the stocks in the first subset, and we short the same dollar amount in an equally weighted portfolio of the stocks in the second subset. Note that, if we do not consider transaction costs, the initial value of this long-short portfolio is zero. For this reason, such a portfolio is said to be dollar-neutral. We cannot define return for this portfolio, but its profit/loss is

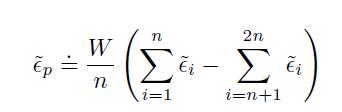

Where,

accounts for specific risk. Note that the portfolio is, in fact, market neutral, and that for large \(n\) the total contribution of specific risk is diversified away.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte