Consider a correlation matrix for asset returns. Correlation coefficients may be positive or negative, but common sense

Question:

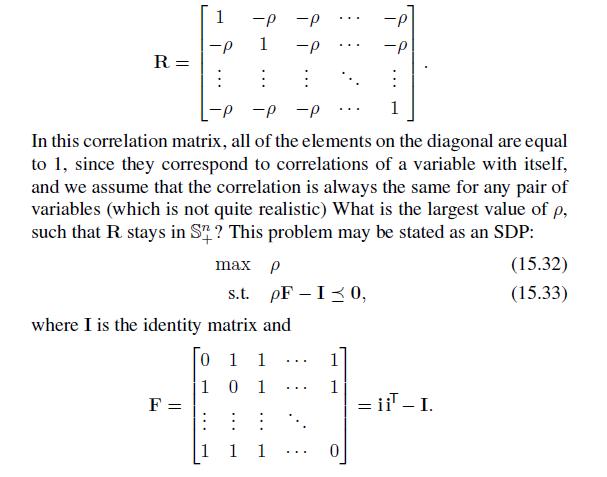

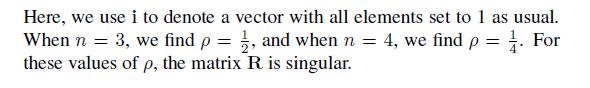

Consider a correlation matrix for asset returns. Correlation coefficients may be positive or negative, but common sense suggests that cycles of negative correlation coefficients may be problematic. For instance, say that random returns ~r1 and ~r2 are negatively correlated, and ~r2 and ~r3 are, too. Can ~r1 and ~r3 be negatively correlated as well? Maybe yes, but only up to a point. Let us consider a fictitious correlation matrix involving a single correlation coefficient ![]()

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: