Consider an individual asset, with random holding period return (r_{i}), and the market portfolio, with corresponding return

Question:

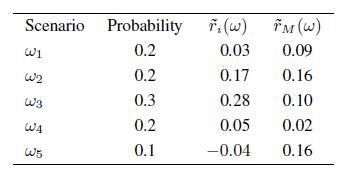

Consider an individual asset, with random holding period return \(r_{i}\), and the market portfolio, with corresponding return \(r_{M}\). We describe uncertainty by five discrete scenarios, as in the following table:

- Assuming that CAPM holds, find the risk-free return.

- Does the result look sensible? If not, how can you explain the anomaly?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: