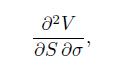

In risk management, we sometimes need second-order sensitivities, like gamma. Vanna is defined as where V is

Question:

In risk management, we sometimes need second-order sensitivities, like gamma. Vanna is defined as

where V is the option value. This may be regarded as the derivative of delta with respect to volatility, or the derivative of vega with respect to the current price of the underlying asset. Let us assume that the BSM model applies. Is vanna different for call and put options? Find a formula for the option vanna.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: