You hold a long position in a call and a short position in a put, written on

Question:

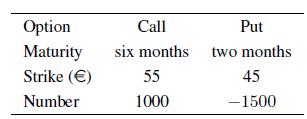

You hold a long position in a call and a short position in a put, written on the same non-dividend-paying stock share, but having different strikes and maturities, as reported in the table below (note that the number of puts held is negative):

The underlying asset price follows a GBM with drift coefficient 13%. The current volatility is 35%, while the continuously compounded risk-free rate is 4% for all maturities; the current underlying asset price is 50. Is your position long or short with respect to volatility? Note: When you are long a risk factor, it means that you gain if the factor increases; you are short the risk factor, if you gain when its value drops. We consider only small variations.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte