Say that we own a piece of real estate and we want to insure it against a

Question:

Say that we own a piece of real estate and we want to insure it against a disaster that may occur with probability \(p\). If disaster strikes, our loss is \(100 \%\) of the property value. Risk may be represented by a Bernoulli random variable:

- With probability \(p\), return is 1 (we lose \(100 \%\) of the property).

- With probability  , return is 0 .

, return is 0 .

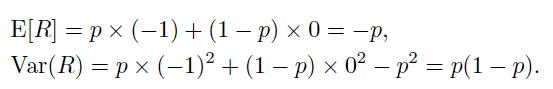

Then,

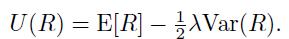

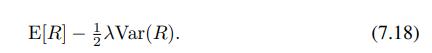

Note that the expected return is negative, as we are facing a potential loss. By abusing proper quadratic utility a little bit, let us consider the mean-risk form of Eq. (7.18),

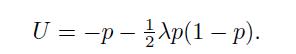

In this specific case, the utility score is, for a given risk aversion coefficient

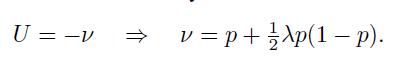

We may consider insuring the property for a given premium. The more we are willing to pay, the more risk-averse we are. If we are willing to pay at most , then the utility of the certain equivalent loss of is equal to the above utility score:

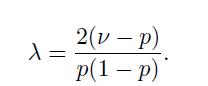

As a reality check, observe that a risk-neutral investor \((=0)\) would just pay \(p\), the expected loss. Given the insurance premium that we are willing to pay, this relationship allows to figure out a sensible value of  , since

, since

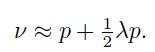

To get a more intuitive feeling, imagine that \(p\) is small (1 \(\quad p \quad 1\), so that

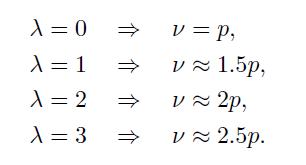

Let us try a few values of  :

:

Therefore, for each unit increment in the risk aversion coefficient, we should be willing to pay another \(50 \%\) of the expected loss.

In portfolio optimization, it is commonly agreed that ranges between 2 and 4.

Data From Equation (7.18)

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte