The risk-free rates with maturities of 6,12 , and 18 months are, respectively, (2.3 %, 2.8 %),

Question:

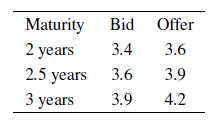

The risk-free rates with maturities of 6,12 , and 18 months are, respectively, \(2.3 \%, 2.8 \%\), and \(3.2 \%\) (with continuous compounding). We also have the following swap rates:

We assume semiannual payments, and the swap rates are semiannually compounded (this is consistent with market conventions). For the sake of simplicity, we neglect day count issues and take for granted that all months consist of 30 days. A callable bond with no default risk has coupon rate \(10 \%\) and matures in two years. The bond trades for €97.12. What is the value of a call option on the corresponding noncallable bond?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: