Let us check the accuracy of the approximation in Eq. (6.3) for a couple of zeros maturing

Question:

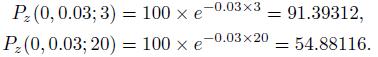

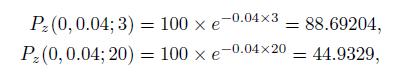

Let us check the accuracy of the approximation in Eq. (6.3) for a couple of zeros maturing in 3 and 20 years, respectively. If the continuously compounded yield \(r\) is \(3 \%\), we have

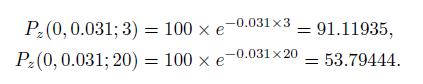

Note that, in practice, prices should be rounded to cents, but we refrain from doing so, in order to better illustrate numerical accuracy. If there is an upshift by ten basis points,

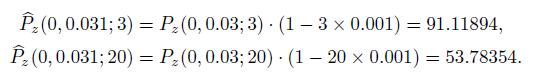

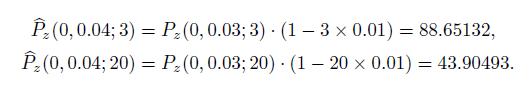

The approximate prices \(P_{z}\) predicted by the duration approximation are:

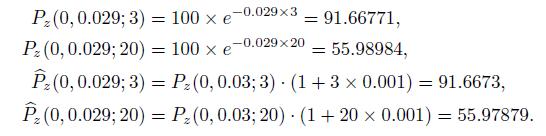

We observe that the approximation seems a bit less accurate for the longer maturity zero, and that the duration approximation is somewhat "pessimistic," in the sense that it gives a lower price than exact repricing. A similar pattern occurs if there is a downshift by ten basis points:

Again, we observe that duration predicts a lower price than the exact one. When a larger shift occurs, accuracy is less impressive. For instance, if there is an increase by 100 basis points, we have

but the first-order approximation based on duration yields

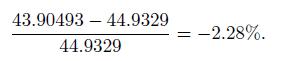

The last approximation, in particular, is rather inaccurate and overly pessimistic, with a percentage error of

Data From Equation (6.3)

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte