We have invested ($100),000 in Quacko Corporation stock shares, whose daily volatility is (2 %). This means

Question:

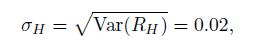

We have invested \($100\),000 in Quacko Corporation stock shares, whose daily volatility is \(2 \%\). This means that the volatility of asset return is

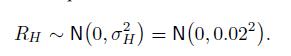

where the holding period \(H\) is one day and \(R_{H}\) is the daily return. For the sake of simplicity, let us assume that the return is normally distributed. Given the square-root rule,

Loss over the holding period is \[L_{H}=W_{0} R_{H}\]

where the initial wealth \(W_{0}\) is \(\$ 100,000\). The expected value of loss is \(\mathrm{E}\left[L_{H}\right]=0\), and its volatility is \[{ }_{L}=\overline{\operatorname{Var}\left(L_{H}\right)}=\overline{\left(W_{0}\right)^{2} \quad \operatorname{Var}\left(R_{H}\right)}=W_{0} \quad H\]

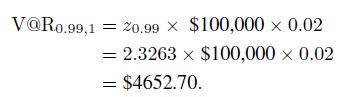

We know that quantiles of a normal distribution are related to quantiles \(z_{1} \quad\) of a standard normal variable. If we want daily V \(@ \mathrm{R}\) with \(99 \%\) confidence level, we find

Therefore, we are "99\% sure" that we will not lose more than \(\$ 4652.70\) in one day.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte