As shown in this chapter, Merton (1973) shows that for the case of an asset with price

Question:

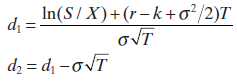

As shown in this chapter, Merton (1973) shows that for the case of an asset with price S paying a continuously compounded dividend yield k , this leads to the following call option pricing formula:C = Se?kTN(d1) ? Xe?rTN(d2),where

a. Modify the BSCall and BSPut functions defined in this chapter to fit the Merton model.

b. Use the function to price an at-the-money option on an index whose current price is S = 1500, when the option?s maturity T = 1, the dividend yield is k = 2.2%, its standard deviation ? = 20%, and the interest rate r = 7%.

In(S/ X)+(r-k+o?/2)T d = oVT dz = d, -oVT

Step by Step Answer:

a Heres how we can modify the BSCall and BSPut functions defined in the chapter to fit the Merton mo...View the full answer

Related Video

A call option is a type of financial contract that gives the holder the right, but not the obligation, to buy an underlying asset (such as a stock, commodity, or currency) at a specified price (called the strike price) within a specified period of time. When an investor purchases a call option, they are essentially betting that the price of the underlying asset will rise above the strike price before the option\'s expiration date. If the price of the asset does rise above the strike price, the investor can exercise the option by buying the asset at the strike price and then selling it at the higher market price, thereby earning a profit. Call options are often used as a speculative investment strategy, as they allow investors to potentially profit from the upward movement of an asset without having to actually own the asset itself. They are also commonly used as a hedging tool to protect against potential losses in a portfolio.

Students also viewed these Business questions

-

For the case of an ideal gas find the equation of the process (in the variables T, V) in which the molar heat capacity varies as: (a) C = Cv + aT; (b) C = Cv + V; (e) C = Cv + ap, Where a, , and a...

-

The bubble sort algorithm shown in this chapter is less efficient than it could be. If a pass is made through the list without exchanging any elements, this means that the list is sorted and there is...

-

For the case of nitrogen under standard conditions find: (a) The mean number of collisions experienced by each molecule per second; (b) The total number of collisions occurring between the molecules...

-

Cinderella's income increases by 25%. She decides to increase her purchases of glass slippers by 40%. To her, glass slippers are a(n)____________good and her income elasticity of demand for glass...

-

Your discussion with a client has turned to the measurement of investment performance, particularly with respect to international portfolios. a. Assume that the data in this table for Manager A and...

-

In 1982, a subsidiary of W. S. Kirkpatrick & Co. won a Nigerian Defense Ministry contract for the construction and equipment of an aeromedical center at a Nigerian Air Force base. Environmental...

-

Write a code to test a Gaussian pseudorandom number generator. If you do not have a canned generator available, write a generator based on the Box-Muller algorithm in Appendix I. Apply the following...

-

Nonmonetary Exchange Alatorre Corporation, which manufactures shoes, hired a recent college graduate to work in its accounting department. On the first day of work, the accountant was assigned to...

-

Arbon Company has three service departments and two operating departments. Selected data concerning the five departments are presented below: Costs Number of employees Square metres of space occupied...

-

Choose your preferred national, regional, and local news media in each of the groups. Identify the number of articles that criticize business or an employer-related decision. Identify the number of...

-

The table below gives prices for American Airlines (AMR) options on 12 July 2007. The option with exercise price X = $27.50 is assumed to be the at-the-money option. a. Compute the implied volatility...

-

Note that you can use the Black-Scholes formula to calculate the call option premium as a percentage of the exercise price in terms of S/X: where Implement this in a spreadsheet. C=SN(d))-Xe"T...

-

The vessel on the left contains a mixture of oxygen and nitrogen at atmospheric pressure. The vessel on the right is evacuated. (a) Describe what will happen when the stopcock is opened. (b) If you...

-

Many organizations use the performance appraisals of employees to guide merit pay decisions. Using an organization that you are familiar with (by working there, reading about it, knowing someone who...

-

What are the key regulatory proteins and signaling pathways involved in the transition from quiescence (G0) to the proliferative cell cycle, and how do extracellular signals, growth factors, and cell...

-

What are the mechanisms underlying the coordination of cell cycle progression with cellular metabolism, energy production, and nutrient availability, and how do metabolic checkpoints and signaling...

-

One way many business here in the logistical fields is is production standards. This is a great way that we can see if our employees are meeting the daily goals to help produce the companies goods....

-

Larry (not a highly compensated employee) works for Lucky's Lemonade, a company that sells lemonade machines. Lucky's Lemonade normally has a gross profit percentage of 40%. Larry's wife loves...

-

If S = 1/10(t4 - 14t3 + 60t2), find the velocity of the moving object when its acceleration is zero.

-

Players A, B, and C toss a fair coin in order. The first to throw a head wins. What are their respective chances of winning?

-

Identify when leadership may not be necessary.

-

Does charismatic/transformational leadership generalize across cultures?

-

Contrast leadership and power.

-

Computing the Carrying Value of Intangibles On January 3, Munn and Cody entered into a noncompetition agreement in connection with Munn's purchase of a trademark from Cody. Munn paid Cody $880,000,...

-

Design the logic and write the Python code that will use assignment statements to: Task 1 : Calculate the profit ( profit ) as the retail price minus the wholesale price. Task 2 : Calculate the sale...

-

How do cytokine storms arise, and what are the underlying immunological mechanisms that lead to their pathogenicity in severe inflammatory conditions such as sepsis or cytokine release syndrome?

Study smarter with the SolutionInn App