Question: Based on Exhibit 1, if Yetas management implemented Proposal #3 at the current share price, earnings per share would: A. decrease. B. remain unchanged. C.

Based on Exhibit 1, if Yeta’s management implemented Proposal #3 at the current share price, earnings per share would:

A. decrease.

B. remain unchanged.

C. increase.

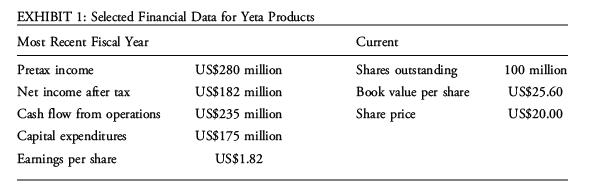

John Ladan is an analyst in the research department of an international securities firm. Ladan is currently analyzing Yeta Products, a publicly traded global consumer goods company located in the United States. Selected data for Yeta are presented in Exhibit 1.

Yeta currently does not pay a dividend, and the company operates with a target capital structure of 40% debt and 60% equity. However, on a recent conference call, Yeta’s management indicated that they are considering four payout proposals:

Proposal #1: Issue a 10% stock dividend.

Proposal #2: Repurchase US\($40\) million in shares using surplus cash.

Proposal #3: Repurchase US\($40\) million in shares by borrowing US\($40\) million at an after-tax cost of borrowing of 8.50%.

Proposal #4: Initiate a regular cash dividend.

EXHIBIT 1: Selected Financial Data for Yeta Products Most Recent Fiscal Year Pretax income US$280 million Net income after tax US$182 million Cash flow from operations US$235 million Capital expenditures US$175 million Earnings per share US$1.82 Current Shares outstanding Book value per share Share price 100 million US$25.60 US$20.00

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts