Question: Based on Yetas target capital structure, Proposal #4 will most likely: A. increase the default risk of Yetas debt. B. increase the agency conflict between

Based on Yeta’s target capital structure, Proposal #4 will most likely:

A. increase the default risk of Yeta’s debt.

B. increase the agency conflict between Yeta’s shareholders and managers.

C. decrease the agency conflict between Yeta’s shareholders and bondholders.

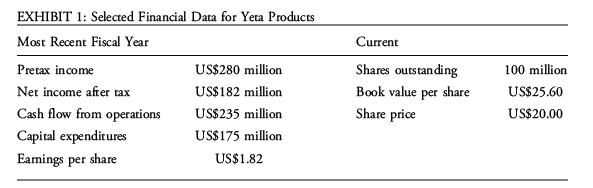

John Ladan is an analyst in the research department of an international securities firm. Ladan is currently analyzing Yeta Products, a publicly traded global consumer goods company located in the United States. Selected data for Yeta are presented in Exhibit 1.

Yeta currently does not pay a dividend, and the company operates with a target capital structure of 40% debt and 60% equity. However, on a recent conference call, Yeta’s management indicated that they are considering four payout proposals:

Proposal #1: Issue a 10% stock dividend.

Proposal #2: Repurchase US\($40\) million in shares using surplus cash.

Proposal #3: Repurchase US\($40\) million in shares by borrowing US\($40\) million at an after-tax cost of borrowing of 8.50%.

Proposal #4: Initiate a regular cash dividend.

EXHIBIT 1: Selected Financial Data for Yeta Products Most Recent Fiscal Year Pretax income US$280 million Net income after tax US$182 million Cash flow from operations US$235 million Capital expenditures Earnings per share US$175 million US$1.82 Current Shares outstanding Book value per share Share price 100 million US$25.60 US$20.00

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

A is correct Yeta is financed by both debt and equity therefore paying dividends can increase the a... View full answer

Get step-by-step solutions from verified subject matter experts