Based on Exhibit 2, Topmakers investment in Rainer resulted in goodwill of: A. ($21) million. B. ($60)

Question:

Based on Exhibit 2, Topmaker’s investment in Rainer resulted in goodwill of:

A. \($21\) million.

B. \($60\) million.

C. \($99\) million.

John Thronen is an analyst in the research department of an international securities firm.

Thronen is preparing a research report on Topmaker, Inc., a publicly-traded company that complies with IFRS. Thronen reviews two of Topmaker’s recent transactions relating to investments in Blanco Co. and Rainer Co.

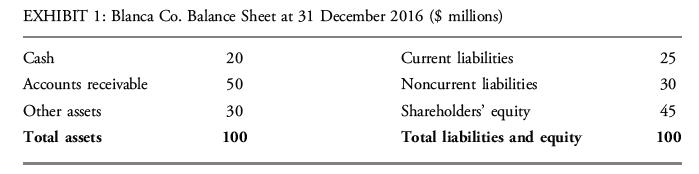

Investment in Blanca Co.

On 1 January 2016, Topmaker invested \($11\) million in Blanca Co. debt securities (with a 5.0% stated coupon rate on par value, payable each 31 December). The par value of the securities is \($10\) million, and the market interest rate in effect when the bonds were purchased was 4.0%. Topmaker designates the investment as held-to-maturity. On 31 December 2016, the fair value of the securities was \($12\) million.

Blanca Co. plans to raise \($40\) million in capital by borrowing against its financial receivables. Blanca plans to create a special purpose entity (SPE), invest \($10\) million in the SPE, have the SPE borrow \($40\) million, and then use the total funds to purchase \($50\) million of receivables from Blanca. Blanca meets the definition of control and plans to consolidate the SPE. Blanca’s current balance sheet is presented in Exhibit 1.

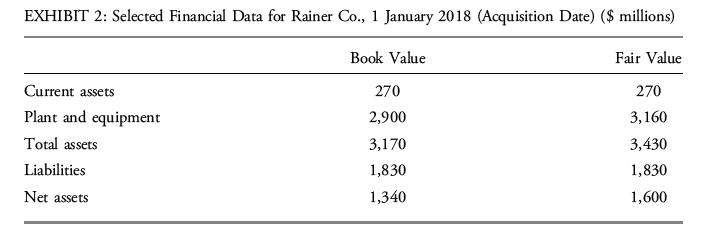

Investment in Rainer Co.

On 1 January 2016, Topmaker acquired a 15% equity interest with voting power in Rainer Co. for \($300\) million. Exhibit 2 presents selected financial information for Rainer on the acquisition date. Thronen notes that the plant and equipment are depreciated on a straightline basis and have 10 years of remaining life. Topmaker has representation on Rainer’s board of directors and participates in the associate’s policy-making process.

Thronen notes that, for fiscal year 2018, Rainer reported total revenue of \($1,740\) million and net income of \($360\) million, and paid dividends of \($220\) million.

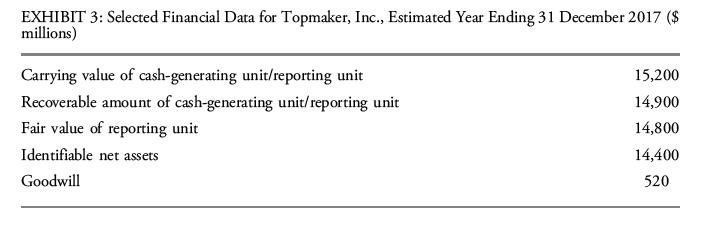

Thronen is concerned about possible goodwill impairment for Topmaker due to expected changes in the industry effective at the end of 2017. He calculates the impairment loss based on selected data from the projected consolidated balance sheet data presented in Exhibit 3, assuming that the cash-generating unit and reporting unit of Topmaker are the same.

Finally, Topmaker announces its plan to increase its ownership interest in Rainer to 80%

effective 1 January 2018 and will account for the investment in Rainer using the partial goodwill method. Thronen estimates that the fair market value of the Rainer’s shares on the expected date of exchange is \($2\) billion with the identifiable assets valued at \($1.5\) billion.

Step by Step Answer:

Corporate Finance Workbook Economic Foundations And Financial Modeling

ISBN: 9781119743811

3rd Edition

Authors: CFA Institute, Michelle R. Clayman, Martin S. Fridson, George H. Troughton