Question: Consider a portfolio of two stocks whose statistical parameters are given below. Stock A: Annual mean return = 15%, annual standard deviation of return =

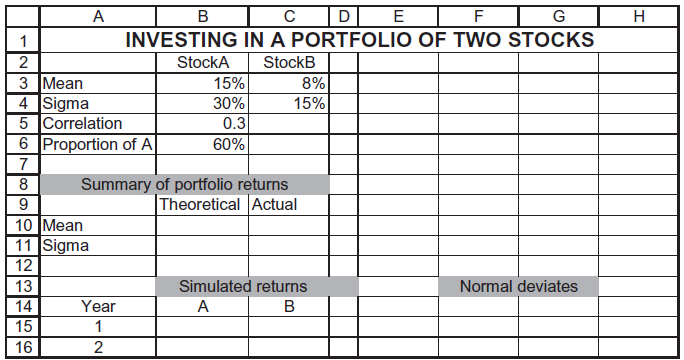

Consider a portfolio of two stocks whose statistical parameters are given below.

Stock A: Annual mean return = 15%, annual standard deviation of return = 30%.

Stock B: μ = 8%, σ= 15%.

Correlation(A,B) = ρ = 0.3

An investor with a buy-and-hold strategy buys a portfolio composed of 60% A and 40% B and holds it for 20 years. Simulate the annual returns on the portfolio. A suggested template is given below.

1 2 3 Mean 4 Sigma 5 Correlation 6 7 8 9 10 Mean 11 Sigma 12 13 14 15 56 A 16 Proportion of A B C D E F G INVESTING IN A PORTFOLIO OF TWO STOCKS StockA StockB Year 1 2 15% 30% 0.3 60% 8% 15% Summary of portfolio returns Theoretical Actual Simulated returns A B Normal deviates H

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

No significant indexed lists found Here is a reproduction of the yearly profits from the ... View full answer

Get step-by-step solutions from verified subject matter experts