In a well-known paper, Roll (1978) discusses tests of the SML in a four-asset context: a. Derive

Question:

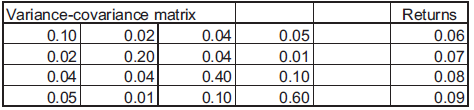

In a well-known paper, Roll (1978) discusses tests of the SML in a four-asset context:

a. Derive two efficient portfolios in this 4-asset model and draw a graph of the efficient frontier.

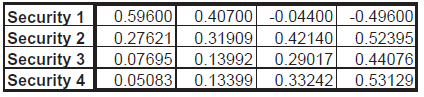

b. Show that the following four portfolios are efficient by proving that each is a convex combination of the two portfolios you derived in part a above:

c. Suppose that the market portfolio is composed of equal proportions of each asset (i.e., the market portfolio has proportions (0.25,0.25,0.25,0.25)). Calculate the resulting SML. Is the portfolio (0.25,0.25,0.25,0.25) efficient?

d. Repeat this exercise, but substitute one of the four portfolios of part b above as the candidate for the market portfolio.

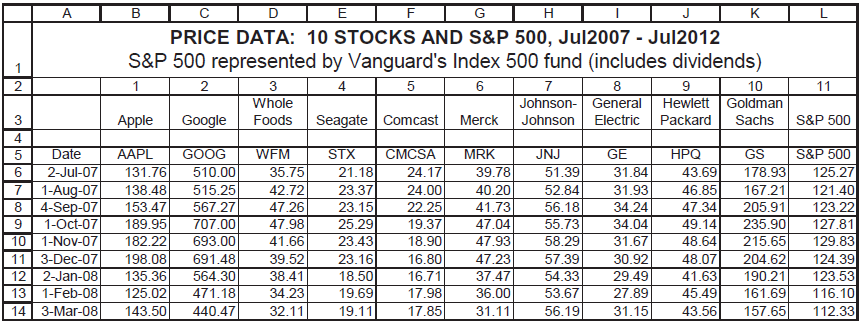

The remaining questions relate to a data set for 10 stocks. The data are given on the exercise file with this chapter.

Step by Step Answer: