Question: This exercise asks you to repeat the computations of section 11.1 for a somewhat different percent. In the fi le fm3_problems11.xls you will fi nd

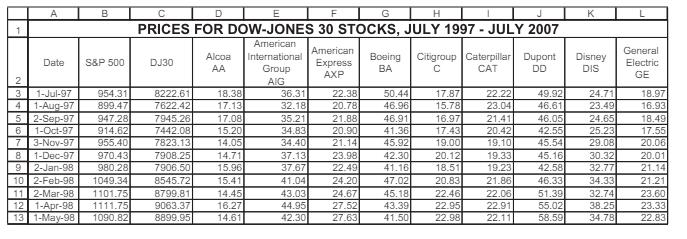

This exercise asks you to repeat the computations of section 11.1 for a somewhat different percent. In the fi le fm3_problems11.xls you will fi nd monthly returns for the Dow-Jones 30 Industrials and the S&P 500 for July 1997–July 2007.

a. Regress the monthly returns of each of the stocks on the S&P 500, computing the slope, intercept, R2 and t-statistics for the slope and intercept.

b. Perform the second-pass regression: Regress the average monthly return of each stock on its beta. Analyze the results.

A B C 1 DE F G PRICES FOR DOW-JONES 30 STOCKS, JULY 1997 JULY 2007 - K L Date S&P 500 DJ30 Alcoa AA American International Group American Express General Boeing Citigroup Caterpillar Dupont BA Disney Electric CAT DD DIS AXP GE 2 AIG 3 1-Jul-97 954.31 8222.61 18.38 36.31 22.38 50.44 17.87 22.22 49.92 24.71 18.97 4 1-Aug-97 899.47 7622.42 17.13 32.18 20.78 46.96 15.78 23.04 46.61 23.49 16.93 5 2-Sep-97 947.28 7945.26 17.08 35.21 21.88 46.91 16.97 21.41 46.05 24.65 18.49 6 1-Oct-97 914.62 7442.08 15.20 34.83 20.90 41.36 17.43 20.42 42.55 25.23 17.55 7 3-Nov-97 955.40 7823.13 14.05 34.40 21.14 45.92 19.00 19.10 45.54 29.08 20.06 8 1-Dec-97 970.43 7908.25 14.71 37.13 23.98 42.30 20.12 19.33 45.16 30.32 20.01 9 2-Jan-98 10 2-Feb-98 1049.34 980.28 7906.50 15.96 37.67 22.49 41.16 18.51 19.23 42.58 32.77 21.14 8545.72 15.41 41.04 24.20 47.02 20.83 21.86 46.33 34.33 21.21 11 2-Mar-98 1101.75 8799.81 14.45 43.03 24.67 45.18 22.46 22.06 51.39 32.74 23.60 12 1-Apr-98 1111.75 9063.37 16.27 44.95 27.52 43.39 22.95 22.91 55.02 38.25 23.33 13 1-May-98 1090.82 8899.95 14.61 42.30 27.63 41.50 22.98 22.11 58.59 34.78 22.83

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts